Posited as the domestic competitor to TikTok, albeit with less international traction, Kuaishou (referred to as Kwai internationally), “an algorithm-based video-sharing platform” (Lin & de Kloet, 2019, p. 1), encapsulates the early, utopic imaginaries of the internet and is asserted as a prospective solution to China’s social, economic, and cultural problems. The platform business’ appeal, and by extension, domestic and burgeoning global prominence, is attributed to its synonymity with freedom, prosperity, and empowerment. Means of monetising content – with livestreaming, in-app advertising, and e-commerce comprising the sources of revenue – as well as concerns regarding platform labour and governance, are addressed in the essay.

What is Kuaishou? Understanding China’s video-sharing app by South China Morning Post.

Dissecting Statistics

“Authentic, Diverse, Beautiful, and Beneficial”

Domestically, and to a lesser extent internationally, Kuaishou is an extremely successful platform, with its vision to “embrace all lifestyles” and core values – “Authentic, Diverse, Beautiful, and Beneficial” – imperative in securing its position as a leader within the oversaturated, Chinese video-sharing industry. Founded by Su Hua and Cheng Yixiao, Kuaishou launched in 2012 and soon amassed a dedicated following, with majority of registered users from socioeconomic marginalities: young (74.9% are under the age of 25), less educated (87.6% have not attended university), penurious (approximately 70% earn less than RMB300 a month) and live in lower tiered cities (41.8% live in third-tiered cities) (Tan et al., 2020). The platform emerged in the domestic market with more than 400 million registered users and an approximate worth of US$2 billion. Globally, Kuaishou recorded 700 million registered users. With more than 100 million daily active users, currently, Kuaishou is the country’s fourth largest social media platform, after WeChat, Tencent QQ, and Sina Weibo, and the country’s largest video-sharing platform (Zhai, 2017, as cited in Tan et al., 2020).

Principal Components

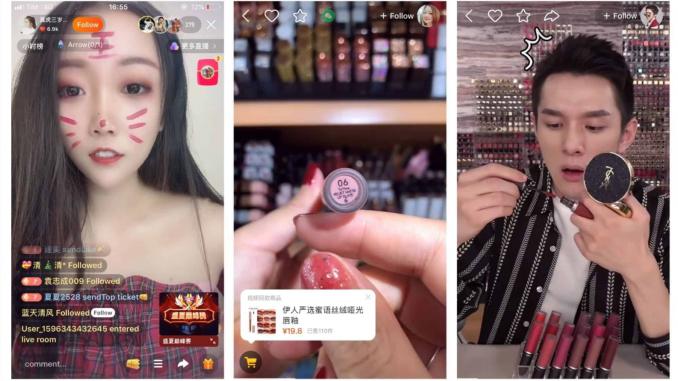

Short videos and livestreaming are the two primary defining features of the platform. Registered users have the ability to produce and distribute short videos, up to 57s long, online, with the option of applying background music and in-app animation effects. Although there remains an influx of video-sharing platforms in China, Kuaishou maintains the notion that “every niche has an audience” (Liu, 2021), and distinguishes itself from its competitors with the “unabashed earthiness” of its contents (Li et al., 2019). Themes of the contents generally distributed range from everyday life – cooking, cosmetics, pets, and family life – to creative skills: including, but not limited to, singing, dancing, fitness, and magic (Lin & de Kloet, 2019). Despite livestreaming encompassing a major portion of Kuaishou’s usage, only a limited number of registered users are authorised to livestream on the platform.

Utopia

Mirroring initial internet visions, the transforming potentials of Kuaishou as a means of upward socioeconomic mobility has enhanced the platform’s appeal to users. Reflecting the sentiment that “we were all going to be millionaires, all going to be creators” (Karpf, 2018, para. 28), Kuaishou provides for the marginalised demographics an opportunity to become self-employed digital entrepreneurs (Lin & de Kloet, 2019). Encompassing notions attached to the early ideas of the internet, including freedom, prosperity, and empowerment, Chinese mainstream media have labelled Kuaishou as “revitalising Chinese rural culture” (Liu, 2017, as cited in Lin & de Kloet, 2019).

Sources of Revenue

As a payment is not required when downloading the application, Kuaishou’s revenue sources consists of a gift economy through livestreaming, in-app advertising, and e-commerce. The gift economy embedded in its livestreaming service is the platform’s primary source of revenue, composing approximately 68.5% of Kuaishou’s annual revenue (Wu & Qin, 2021). Using Kuaibi, a virtual currency on Kuaishou, but bought with actual money, fans are able to purchase and send virtual presents to their preferred streamers. 10 Kuaibi can be exchanged for RMB1, with 188 Kuaibi being the maximum price for a virtual present (Lin & de Kloet, 2019). For each virtual purchase, after deducting 20% for tax, Kuaishou receives 50% commission while streamers obtain less than 40% (Lin & de Kloet, 2019).

Advertising is another fundamental source of revenue and can be categorised into promotion by the self – “fans headline” – or by third-party companies. The former means of advertising enables content creators to self-promote content on Kuaishou for a payment of RMB37.9, subsequently leading to an increase of 10,000 views from end-users (Lin & de Kloet, 2019). The latter means of advertising refers to the purchasing of advertising space on the platform’s interface by third-party companies, whereby commercials are assimilated into videos and released to registered users by Kuaishou’s algorithm. Purchasing advertising space requires an initial payment of RMB5,600, with advertisers paying RMB0.2 for additional clicks (Zhiyuan, 2018, as cited in Lin & de Kloet, 2019). In part, attributed to the COVID-19 pandemic, Kuaishou’s advertising revenue in 2020 increased by 200%.

In China, the relationship between platforms and infrastructures are highly advanced, largely accredited to the integration of e-commerce into domestic platforms (de Kloet et al., 2019). In 2020, JD.com – an e-commerce giant – and Kuaishou signed a strategic partnership, whereby Kuaishou users are able to take advantage of the benefits of JD.com, namely JD.com’s efficient deliveries and after-sales services, as well as the capability to purchase products provided by JD.com without leaving Kuaishou (Wu & Qin, 2017). Enhanced by the COVID-19 pandemic, where e-commerce and online streaming industries have experienced burgeoning demands, the addition of e-commerce into Kuaishou’s business model has greatly boosted the platform’s revenue.

Empowerment or Exploitation?

Throughout the internet’s existence, there have been numerous transformations, including commercialisation of the internet, which by extension, have resulted in the exploitation of the gift economy by business models. With the expansion of the digital landscape, succumbing to commercial pressures, platform labour, as well as issues of governance are unavoidable. Kuaishou is no exception, with concerns of exploitation and governance surrounding the platform in recent years.

Platform labour, specifically the exploitation of streamers, on Kuaishou is an emerging problem. To maximise material gain, the “capitalisation of one’s knowledge and memories” (Tan et al., 2020) is necessary, with streamers employing upon a plethora of personal experiences to share stories that resonate with and complement their audiences’ preferences. Furthermore, “the constant monetisation of virtual gifting precludes possibilities of empowerment and increases platform exploitation and inequality” (de Kloet et al., 2019, p. 253), and as aforementioned, with streamers obtaining less than 40% of the initial price spent on each acquired virtual present, streamers can be severely underpaid when the investment of resources – time, thought, and effort on each produced content – are factored in.

Curated National Imagery

With state regulation and intervention more prominent in China’s digital economy than in the West (de Kloet et al., 2019), governance of Chinese digital platforms presents another tension, producing uncertainty and insecurity among Kuaishou’s content creators. To promote the country as a “conforming culture that ensures social stability and national unity” (Lin & de Kloet, 2019, p. 4), Kuaishou’s registered users are obliged to generate content in line with authorities’ expectations. In order to not breach the platform’s regulation, which would be associated with going against the state, pinning sentiments expressing appreciation of Kuaishou, including “thank you Kuaishou for providing such a wonderful platform” and “I support Kuaishou for transmitting positive value” (Lin & de Kloet, 2019, p. 7), onto the homepage is implicitly endorsed.

“The Chinese authorities have been eager to promote a carefully curated national imagery” (Lin & de Kloet, 2019, p. 4)

For China’s marginalised communities, Kuaishou, which offers prosperity and empowerment through creative means, is a promising outlet for enhancing socioeconomic status. Already established as a powerhouse in the domestic video-sharing industry, Kuaishou’s expansion into the foreign markets is attracting an influx of subscribers, subsequently increasing the platform’s brand recognition and revenue. In addition, the business relies on livestreaming, advertising, and e-commerce as its sources of revenue. Although the enabling possibilities of Kuaishou must be acknowledged, the transition from empowerment to exploitation of its content producers, as well as platform governance are issues that have enveloped Kuaishou since going mainstream.

References

de Kloet, J., Poell, T., Zeng, G., & Chow Y. F. (2019). The platformization of Chinese society: Infrastructure, governance, and practice. Chinese Journal of Communication, 12(3), 249-256. https://doi.org/10.1080/17544750.2019.1644008

Karpf, D. (2018, September 18). 25 years of WIRED predictions: Why the future never arrives. WIRED. https://wired.com/story/wired25-david-karpf-issues-tech-predictions/

Li, M., Tan, C. K. K., & Yang, Y. (2019). Shehui ren: Cultural production and rural youths’ use of the Kuaishou video-sharing app in eastern China. Information, Communication & Society, 23(10), 1499-1514. https://doi.org/10.1080/1369118X.2019.1585469

Lin, J., & de Kloet, J. (2019). Platformization of the unlikely creative class: Kuaishou and Chinese digital cultural production. Society Media + Society, 5(4), 1-12. https://doi.org/10.1177/2056305119883430

Liu, A. (2021, May 5). The design behind TikTok’s largest short video competitor: Kuaishou. Bootcamp. https://bootcamp.uxdesign.cc/the-design-behind-tiktoks-largest-short-video-competitor-kuaishou-7784bc3ecf8a

Tan, C. K. K., Wang, J., Wangzhu, S., Xu, J., & Zhu, C. (2020). The real digital housewives of China’s Kuaishou video-sharing and live-streaming app. Media, Culture & Society, 42(7-8), 1243-1259. https://doi.org/10.1177/0163443719899802

Wu, Q., & Qin, Y. (2021). Is kuaishou an exceptional investing opportunity? A comprehensive analysis of the fundamentals using the POCD framework. Advances in Economics, Business and Management Research, 190, 122-127. https://doi.org/10.2991/aebmr.k.210917.021

Kuaishou: A Story by Stephanie Zhang is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.